- Medicare Emergency Room Copayment

- Medicare Emergency Room Copay

- Medicare Emergency Room Billing Guidelines

Original Medicare is a federal health insurance program for seniors and people with certain disabilities. When a Medicare recipient requires emergency care, Medicare does cover emergency room visits for the most part, and the recipient pays a copayment.

Read on to learn more about emergency room costs and how a Medicare Supplement Insurance plan can help reduce what you pay out of pocket for Medicare emergency room coverage.

Urgent care can treat many common conditions and symptoms, including low back pain, sprains, UTIs and nose bleeds — at up to $1,900 less than the emergency room (ER). Medicare Part B can cover emergency services anywhere in the United States. In rare cases, it may also cover them outside of the U.S. Medicare Advantage plans can also provide some coverage for emergency services. Let’s take a closer look at the emergency services coverage and costs you can expect with Medicare. The Emergency Room and Medicare. $90 copay for Medicare-covered emergency room visits Inpatient Hospital Coverage $290 copay per day, days 1 – 6; then $0 copay per day for Medicare-covered hospital stays. When Medicare covers emergency room (ER) visit costs, you typically pay: A copayment for the visit itself A copayment for each hospital service you receive there A coinsurance amount of 20% for the Medicare-approved cost for doctor services.

What is the Copay for Medicare Emergency Room Coverage?

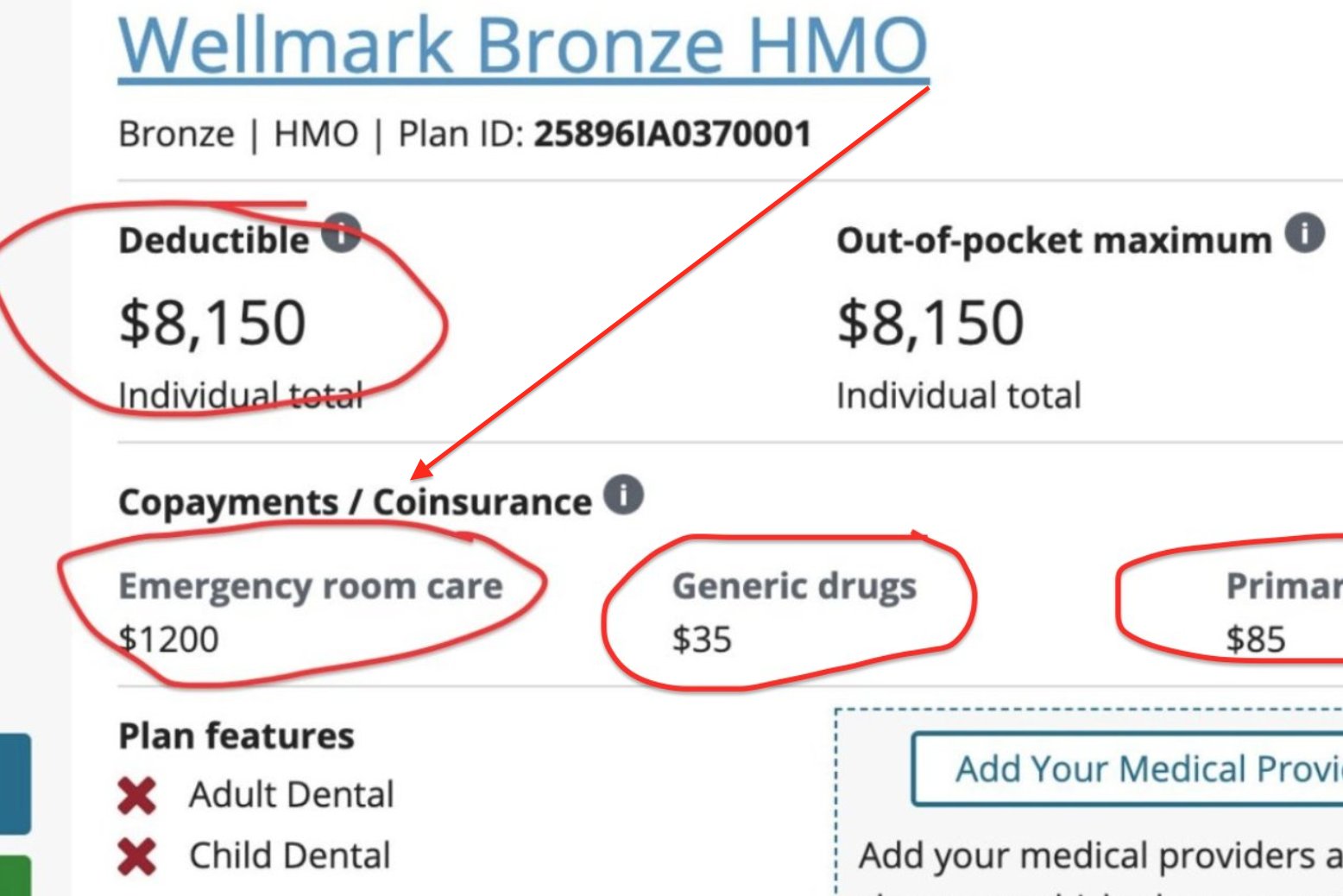

A copay is the fixed amount that you pay for covered health services after your deductible is met. In most cases, a copay is required for doctor’s visits, hospital outpatient visits, doctor’s and hospital outpatients services, and prescription drugs. Medicare copays differ from coinsurance in that they're usually a specific amount, rather than a percentage of the total cost of your care.

Medicare does cover emergency room visits. You'll pay a Medicare emergency room copay for the visit itself and a copay for each hospital service. It is important to remember, however, that your actual Medicare urgent care copay amount can vary widely, depending on the services you require and where you receive care.

If you are admitted for inpatient hospital services after an emergency room visit, Medicare Part A does help cover costs for your hospital stay. Medicare Part A does not cover emergency room visits that don't result in admission for an inpatient hospital stay.

What Does Medicare Pay for Emergency Room Visits?

Medicare Part A emergency room coverage is specifically for inpatient hospital stays. If your emergency room visit requires you to be admitted for inpatient care, your Medicare Part A benefits would kick in but are subject to the Part A deductible and coinsurance.

Most ER services are considered hospital outpatient services, which are covered by Medicare Part B.They include, but are not limited to:

- Emergency and observation services, including overnight stays in a hospital

- Diagnostic and laboratory tests

- X-rays and other radiology services

- Some medically necessary surgical procedures

- Medical supplies and equipment, like splints, crutches and casts

- Preventive and screening services

- Certain drugs that you wouldn't administer yourself

NOTE: There's an important distinction to be made between inpatient and outpatient hospital statuses. Your hospital status affects how much you pay for services. Unless your doctor has written an order to admit you as an inpatient, you're an outpatient, even if you spend the night in the hospital.

How Medicare Part B Pays For Outpatient Services

Medicare Part B pays for outpatient services like the ones listed above, under the Outpatient Prospective Payment System (OPPS). The OPPSpays hospitals a set amount of money (or payment rate) for the services they provide to Medicare beneficiaries.

The payment rate varies from hospital to hospital based on the costs associated with providing services in that area, and are adjusted for geographic wage variations.

Other Medicare Costs

Aside from Medicare ER copays, there are other outpatient hospital costs that you should be aware of when visiting the emergency room, such as deductibles and coinsurance. In most cases, if you receive care in a hospital emergency department and are covered by Medicare Part B, you'll also be responsible for:

- An annual Part B deductible of $203 (in 2021).

- A coinsurance payment of 20% of the Medicare-approved amount for most doctor’s services and medical equipment.

How You Pay For Outpatient Services

In order for your Medicare Part B coverage to kick in, you must pay the yearly Part B deductible. Once your deductible is met, Medicare pays its share and you pay yours in the form of a copay or coinsurance.

Get Help Covering Your Emergency Room Copay

If you're worried about a trip to the emergency room adding expensive and unpredictable costs to your health care budget, consider joining a Medicare Supplement Insurance (or Medigap) Plan. Medigap is private health insurance that Medicare beneficiaries can buy to cover costs that Medicare doesn't, including some copays. All Medigap plans cover at least a percentage of your Medicare Part B coinsurance or ER copay costs.

To find a Medigap plan in your area, call 1-800-995-4219 to connect with a licensed insurance agent.

Does Medicare Part A cover emergency room visits?

If you opted out of Medicare Part B, and only have Part A, you may be wondering if you can get coverage for an emergency room visit. Medicare Part A is designed for hospital insurance, meaning that it's benefits are generally used once admitted to the hospital.

Resource Center

Enter your email address and get a free guide to Medicare and Medicare Supplement Insurance.

By clicking 'Sign up now' you are agreeing to receive emails from MedicareSupplement.com.

We've been helping people find their perfect Medicare plan for over 10 years.

Ready to find your plan?

If you're among the 70-million plus Americans that are enrolled in Medicaid, you might have some questions about Medicaid copay.

You may have heard about a copay before, but you're confused about what it means and how it affects your benefits when it comes to medical expenses.

In this article, we'll cover everything you need to know about Medicaid copay. We'll discuss what it is, how it may affect your medical costs, who is exempt from it, and more.

What is a Medicaid copay?

You've enrolled in Medicaid because you know that it provides access to healthcare, improves your health, and reduces your anxiety and stress when it comes to medical expenses.

But having Medicaid doesn't always mean that your expenses will be zero. For some health services, you might be required to pay a fee, which is known as a Medicaid copay.

You can check with your healthcare provider about if your required service involves a copay. If it does, you will pay them directly.

A Medicaid copay is also known as an out-of-pocket cost. These costs are decided at the state level administration of the Medicaid program.

A state can decide that there are going to be copays associated with various medical services that are covered by Medicaid. The service can be either inpatient (when you're formally admitted to the hospital) or outpatient (not admitted to a hospital, like tests or consultations) services.

The copay in each state will vary. It is usually a percentage based on the total cost to the state for your medical service.

The copay or out-of-pocket expense will also typically vary based on your income. Medicaid, as a program is designed to provide care to low-income individuals. So, the lower your income bracket, the more likely that your copay will be minimal, or in some cases non-existent.

Some services, and specific types of people, are generally exempt from Medicaid copay, regardless of the state.

Who is exempt from Medicaid copay?

The detailed exemption from Medicaid copay may vary depending on the state, but in general the following groups are exempt from Medicaid copay.

- Children

- Pregnant women

- People who have reached their quarterly limit of Medicaid copay (more details below)

- People who are terminally ill, including those in hospice

- Medicaid recipients who are living in an institution

- Alaska Natives and American Indians who have ever received a treatment from the Indian Health Service, tribal health programs, or under contract health services referral

- Women in the Breast and Cervical Cancer Treatment Medicaid Program are exempt from alternative out of pocket costs (copays if your income is above FPL)

One critical factor to keep in mind is that you’ll most likely still have access to medical care even if you don’t fall in the exempt group and can’t pay your out-of-pocket expense, especially if you’re severely ill. But if you aren’t exempt, you might be billed for the unpaid copay later on.

What services may require a Medicaid copay?

There are a variety of services that might require a copay, including the following.

- In patient services, where you are officially admitted to the hospital

- Outpatient services, like tests, consultations, clinic appointments, etc.

- If you have to go the emergency room for non-emergency care

- Prescription drugs

What services are exempt from Medicaid copay?

Services that are exempt from a Medicaid copay include the following.

- Emergency services

- Family planning services like contraceptives, sterilizations, birth control methods, etc.

- Pregnancy-related medical services

- Preventative services, like immunizations, screenings, clinical and behavioral interventions, counseling, etc.

How do I know what my Medicaid copay will be?

Before you calculate your copay, you need to figure out if there is an out-of-pocket expense associated with your medical service in the first place.

To find out if there is a copay, you can simply ask your provider.

For example, if you need to fill a prescription, you can ask the pharmacy about a copay. Or, if you need to see your doctor, check with him or her to see if it qualifies as a preventative visit (no copay) or as an outpatient service (may require copay).

If you do find out that there is an expense associated with your visit, then the amount you will owe depends on something known as the FPL, or Federal Poverty Level, and how your income relates to it.

The copay will depend on what state you’re in, and how much the state pays for your medical service, but more on that later.

First, let’s discuss what FPL is, so you can better estimate what your copay expenses might be, based on the type of services you need.

What is the Federal Poverty Level (FPL)?

The Federal Poverty Level (FPL) is a measure of income issued yearly by the Department of Health and Human Services (HHS).

The HHS uses FPL to decide whether you might qualify for medical programs and benefits, including Medicaid, based on your income.

For 2020, here are the numbers to determine Federal Poverty Level.

- For one individual - An annual income of $12,760.

- For a family of 2 people - An annual household income of $17,240.

- For a family of 3 people - An annual household income of $21,720.

- For a family of 4 people - An annual household income of $26,200.

- For a family of 5 people - An annual household income of $30,680.

- For a family of 6 people - An annual household income of $35,160.

- For a family of 7 people - An annual household income of $39,640.

- For a family of 8 people - An annual household income of $44,120.

A note about income, AGI, and MAGI

We listed the incomes based on the number of people in your household that determine whether you fall over or under the Federal Poverty Level (FPL).

Medicare Emergency Room Copayment

But we have to go one step further and briefly describe how the Health and Human Services (HHS) defines income, when it comes to your eligibility for benefits.

This is where AGI and MAGI come in (we promise this is related to Medicaid copay).

AGI - AGI is your adjusted gross income. It is your income that is deemed taxable after you deduct any eligible expenses, etc.

MAGI - When HHS looks at your income, and whether it falls above or below FPL, they do it based on MAGI, which stands for modified adjusted gross income. It is your AGI, plus any of the following:

- Untaxed foreign income

- Social Security benefits that are non-taxable, if any

- Any tax exempt interest you’ve earned in the previous fiscal year

Another few things to note about MAGI.

- For most Medicaid recipients, MAGI and AGI are very close

- If you earn Supplemental Security Income (SSI), it is not included in MAGI

- Your tax return will not have a MAGI line, because it is only calculated by HHS for health benefit purposes

Ok, now that you’ve got an idea of what FPL is, and how it is calculated by HHS, using MAGI, let’s tie it all back into your Medicaid copay.

How is my income linked with my Medicaid copay amount?

In this section, we’ll provide you with an overview of what you can expect your copay to be depending on where you fall in relation to the FPL.

The Medicaid website was last updated in 2013, so it is quite possible that the payments have changed slightly.

Contact your state Medicaid agency for up to date details

Also, since the rules will vary based on your state, you may want to reach out to your state directly for your specific out-of-pocket expenses regulations. Check out the state by state contact information for Medicaid agencies here.

That being said, let’s take a look at your approximate expenses based on income. Remember, income is classified as your MAGI by the HHS.

Your maximum copayments are capped each quarter, or a 3-month period, like “Jan-Feb-Mar”, “Apr-May-Jun”, etc.

The maximum costs below are all calculated on a quarterly basis.

If your income is at 100% FPL or below

Inpatient care - You maximum copay is $75

Outpatient care - $4

Non-emergency use of ER - $8

Preferred prescription drugs - $4

Non-preferred prescription drugs - $8

If your income is between 100-150% FPL

Inpatient care - 10% of what your state pays for the service.

Outpatient care - 10% of what your state pays for the service.

Non-emergency use of ER - $8

Preferred prescription drugs - $4

Non-preferred prescription drugs - $8

If your income is at above 150% FPL

Inpatient care - 20% of what your state pays for the service.

Outpatient care - 20% of what your state pays for the service.

Non-emergency use of ER - No limit, until you’ve reached your 5% family income max per quarter (more below).

Preferred prescription drugs - $4

Non-preferred prescription drugs - 20% of what your state pays for the drugs.

Is there a limit to my Medicaid copay?

As we’ve briefly mentioned a couple of times, there is a maximum limit of 5 percent of your household income per quarter on your Medicaid copay.

Also known as a “cost-sharing limit”, it means that during a quarter (“Jan-Feb-Mar”, “Apr-May-Jun”, etc.), the maximum amount that you may have to pay as your Medicaid copay is 5 percent of the MAGI for your entire household.

If you reach your 5 percent limit, and you need further medical services that typically require a copay, you will continue to receive treatment without having to pay. The copay will reset back to its regular amount in the beginning of the following quarter.

Can I be refused service if I can’t pay my Medicaid copay?

If your income level falls below 100% FPL, the provider can’t refuse you service even if you’re not able to pay your out-of-pocket expense. But you may be billed for your copay at a later date and you’ll be held liable for what you owe.

If your income is above 100% FPL, then the provider might have the option to refuse you care if you aren’t able to pay your copay, depending on your state. If you fall in this category and you have questions, it is best to contact your state Medicaid administration.

If you fall under one of the exempt groups, the medical services provider who accepts Medicaid can never refuse you service.

For all the details on Medicaid’s “cost-sharing” rules, check out Medicaid.gov’s Overview of Cost Sharing and Premium Requirements.

What is the copay for Medicaid prescriptions?

Medicaid prescription copayments vary based on the classification of the prescribed drug in your state.

Your state will classify some drugs as “preferred” and others and “non-preferred”. The state usually differentiates between generic and brand name drugs through these classifications.

The purpose of placing some drugs on a “preferred” list is for the states to be able to promote the drugs that are most cost-effective. If a generic drug is less costly for the state Medicaid, then they want to promote usage of that drug by assigning lower copayments.

We’ve listed what the copayments might be for prescription drugs (both preferred and non-preferred) in the section above. But in general, if your income is above the 150% FPL mark, then your copayments for non-preferred drugs (typically brand named drugs) are going to be high.

There are a few things to keep in mind when it comes to Medicaid copayments for prescription drugs.

- If the state doesn’t specify between generic and brand name for a specific drug, then they are both considered to be “preferred”.

- If your doctor determines that the “preferred” drug will be less effective than its “non-preferred” counterpart, then you will have the smaller copay for both.

Your doctor will know best, but in most cases it makes sense to go with the generic version if it is in the “preferred” category. You will get the same result for a smaller copay.

Medicaid copay for emergency room (ER) visits

Emergency services are exempt from Medicaid copay. But there are situations and reasons why you may visit the ER even when it is not an emergency. Or, you might not be sure if it’s an emergency and visit the ER to be on the safe side.

In such situations, your state has the right to charge a copay for non-emergency use of emergency room (ER) services.

If your income is below 150% of FPL, then your copy will be nominal. But if it is above 150$ FPL, then there is no limit on the copay, and could reach the max for the quarter, which is 5% of your quarterly household income (a significant amount of money).

Medicaid regulations make sure that the hospitals don’t abuse the ability to charge copays. Before they can charge you a copay for using the ER, the hospital has to meet certain conditions.

- They have to conduct an adequate screening to determine that the situation is not actually an emergency.

- They have to inform you about the costs associated with the non emergency service.

- An alternative non-emergency medical provider is available and accessible with the necessary timeframe to provide treatment.

- The copayment of the alternative provider must be less than the use of the emergency room.

- They must provide you the directions and instructions to access the other provider.

- The hospital must also assist in the process of setting up a visit with an alternative provider.

As you can see, the hospital will have to make sure that there is no additional hassle, cost, or risk to your health before they can charge you a copay for non-emergency use of the ER.

Medicare Emergency Room Copay

Medicaid coverage in the state of New York

There are insurance companies that provide services to Medicare recipients to manage the relationship between the state and the individuals. They make sure that you get all the benefits you’re entitled to and help you navigate the process.

In the state of New York, there are quite a few of these providers. With a little research, you will find the one that best suits your needs.

For detailed information, be sure to check out our page on best Medicaid plans in NY.

Final thoughts on Medicaid copay

Medicaid can seem a bit complicated, and it is. There are federal guidelines, and then there are 50 states who have their own guidelines.

With so many guidelines, it might be a bit of a challenge for you as a recipient when you try to find out what services you have access to and what your copay might be, if any.

But if you have a little patience, you will find the information you need, and you’ll be able to take advantage of Medicaid to improve your health and quality of life.

For Medicaid copays, the two best resources remain your medical provider, and state Medicaid agency.

Medicare Emergency Room Billing Guidelines

Depending on the state you live in, they might have an up-to-date and well-functioning website. But if not, you can always give them a call and find out all you need about your copay, as well as other Medicaid questions.